Services

Real Estate Brokerage | Commercial & Multifamily Financing | Portfolio Management & Consulting

Real Estate Brokerage

Income Real Estate Sales

Real estate investing is more than buying low, selling high or holding and hoping. In depth understanding of Oregon market dynamics, experience and proprietary analysis tools help apply a calculated and fine-tuned investment strategy. Navigating the investment real estate world takes a trusted and experienced guide.

-

New Investors

CCRE was founded on working with investors focused on building a well performing portfolio. We will make sense of the complexities for placing your capital and the transaction process. Whether you are interested in buying your first investment, owner-occupying with sights on entering the investment real estate space or inheriting property we can undewrite a strategy that aligns with your risk tolderance. We start with the education process and illustrating realistic attainable return projections. The hardest part for new investors is getting started, often coined "paralysis by analysis".

-

Existing Portfolios

Investors with existing portfolio comprised of one or more properties and have built up an equity position will find themselves asking, "should I refinance or sell?". CCRE specializes in the analytical and technical side of real estate investing. We start by quantifying your current returns on equity and illustrate both scenarios. Lets discuss your current properties, goals and run the numbers. See a sample Portfolio Analysis & Consulting Report (PAC) in the NEWS & INSIGHTS section.

-

Strategic Real Estate Consulting

It is impossible to build a real estate strategy on surface level market dynamics and return projection estimates. Risk tolerance, hold periods and debt effects on yield require careful calculations and understanding of risk tolerance. With an in-depth knowledge of the strategic options surrounding investment real estate we will build a realistic and attainable strategy that meets your goals. With experience in syndication & pooled funds, 1031 exchanges, capital reallocation, property stablization, value-add and complicated tax dispositions such as seller financing, Deleware Statutory Trusts (DST), structured installment sales, Umbrella Partnership Real Estate Investment Trusts (UPREIT [721 Exchange]) we look to be your life-long trusted advisor.

-

1031 Exchange

The IRC Section 1031 exchange is a powerful real estate tool to defer capital gains and accelerate generational wealth. Navigating the exchange process requires planning and provisions to alleviate the potential of a failed exchange. We can be your trusted guide to planning, executing and navigating the nuances of your exchange(s). We have performed several simutaneous exchange of properties in different market successfully to execute strategies with the goal to scale into larger, higher yielding property types. We can coordinate with your out of state representation for investors interested in moving their capital into the Pacific Northwest. Visit our NEWS & INSIGHTS page for a more in-depth write up of 1031 Exchanges.

-

Exit Strategies

Investors may exit the market for a variety of reasons. Some common instances are associated with the lower appetite for working with tenants and turnover, accessing equity or liquidating for personal or business opportunities. CCRE can help you build the team to oversee your exit. There are several tax advantagous strategies for maneuvering high capital gains exposure from investors with a low basis. Some potential options to explore are structured installment sales, exchanges (1031 or 721), seller carrying, Deleware Statutory Trusts (DST) and Umbrella Policy Real Estate Investment Trusts (UPREIT). Give us a call and lets talk about your options.

-

Out of State Investors

Constant Commercial Real Estate Inc can help investors operating out of state in a number of ways. For clients interested in moving their capital/equity in or out of the Pacific Northwest, we can work cooperatively with your out-of-state representation on the buy and/or sell side.

CCRE has worked with investors with portfolios and projects across the United States on a consulting basis. Our approach and analysis is designed for working with small-medium private investors and can be applied to in any market. We have access to national property data to advise and consult on your existing portfolio and investment project. We may even be able to arrange financing, market depending.

Buyers Agent

A buyers agent is a capital placement specialist and expert in income-property analysis, financing, negotiation and possesses in-depth knowledge of the market.

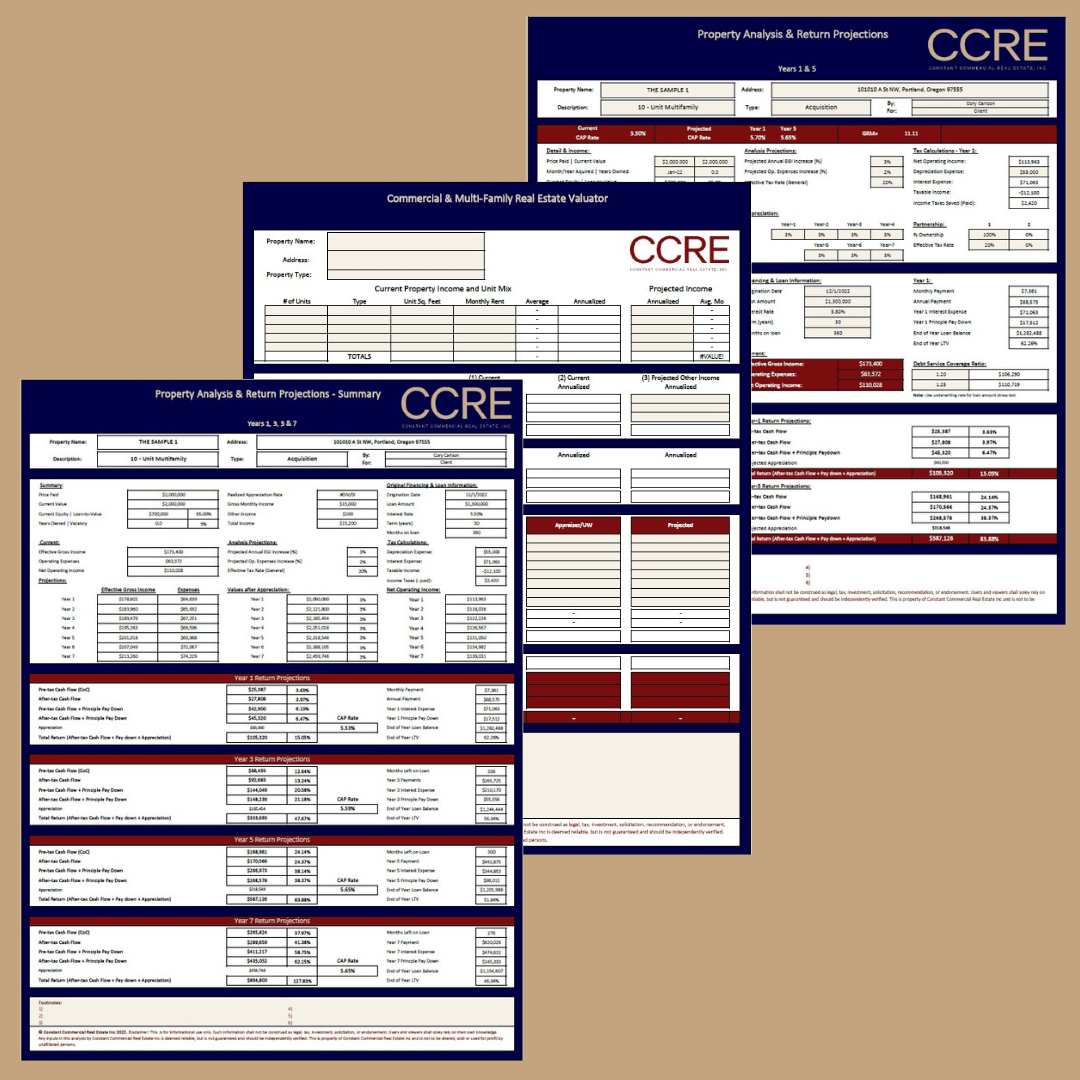

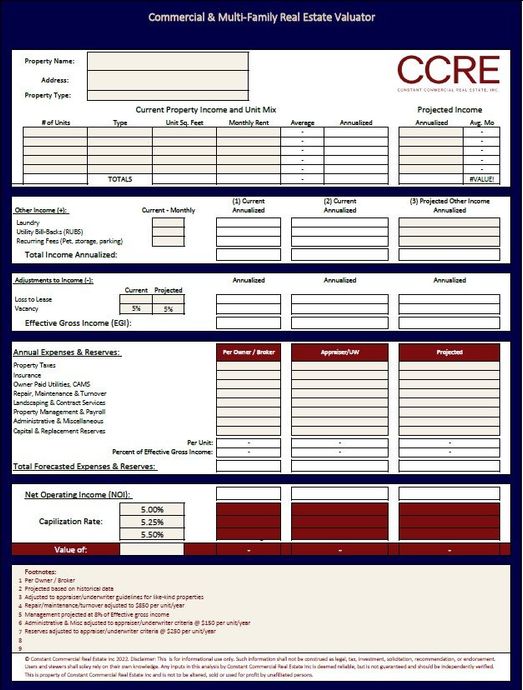

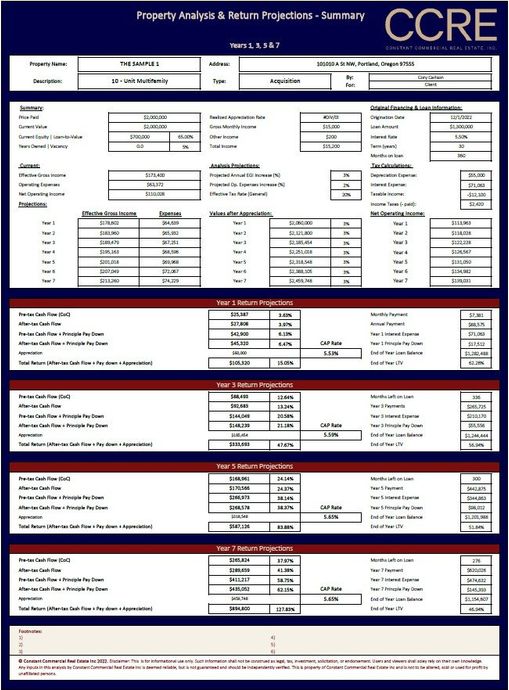

Our processes start by discussing financing, strategy and investor goals. We will present realistic yield projections on actual opportunities illustrated on our proprietary analysis tools. We underwrite each opportunity to identify each properties highest potential, or lack thereof.

Listing Agent

Income-producing real estate listings require a crafted listing plan to maximize exposure and appeal to a variety of investor profiles. Listing investment real estate requires a detail oriented, data driven, well connected negotiator that will utilize both the subjective and objective components of selling income properties.

We are experts in the strategic and analytical components required to accommodate 1031 exchanges, tax-advantageous dispositions and strategic movement of your capital/equity.

Commercial & Apartment Financing

Inquire for Financing

Simple 3 Step Process

STEP 1: Property Financials & Borrower Information

Fill out the

Borrower Information

form and we will provide you a link to access a secure folder to upload due diligence documents.

STEP 2: CCRE Presents Financing Options

We will present and discuss loan options, process, timelines and additional documents required.

STEP 3: Loan to Close

CCRE works with all parties required to get the loan to closing in a timely fashion

Resources & Forms

New Paragraph

Portfolio Management & Consulting

Capital / Equity Management

& General Consulting

We help investors in all stages explore and develop realistic strategies with attainable returns. Return expectations and exit-strategies can be quantified for investors with any strategy considerations. We are here for you beyond just the buy and sell moments.

Buy/Hold Value-add Fix & Flip Short-term Rentals

Forced-Appreciation Exit-Strategies Development

Capital/Equity Management Syndication & Pooled Funds

Portfolio Analysis & Consulting (PAC) Report

A Strategic Real Estate Portfolio Management Report outlining tailored investment strategy.

Real Estate Capital/Equity Management

Our Portfolio Analysis and Consulting report contains:

1) Introduction to the fundamentals of wealth growth, leverage and the major return metrics. Return metrics include pre-tax, after-tax and debt effects on yield.

2) Quantifying current and projected returns on equity across the portfolio and to identify strategy considerations and opportunities for improvement and repositioning.

3) Strategy considerations are quantified based on the investors goals and current portfolios performance. CCRE will provide the supporting analysis and detailed narrative. Considerations to improve will be explored. Improvement options may illustrate a combination of cash-out refinancing, repositioning and dispositions into higher yielding property types.

4) Action items and recommendations of associates to complete the advised strategy. Ie. exchange accommodator, CPA, title company, attorney, financing/mortgage professionals, contractors, photographers, etc.

OUR ADVISING & CONSULTING SERVICES

Ready to discuss your situation?

We are prepared to offer our expertise to your unique situation.