For illustration sake consider a Oregon investor who owns three single-family rentals free and clear throughout the Salem, Gresham and Milwaukie markets. Each are generating an average of $2,500 per door. After factoring 5% vacancy, taxes, insurance, repair/maintenance, management, landscaping and reserves the projected net operating income (NOI) is ~$20,000 each. Remember net operating income EXCLUDES debt.

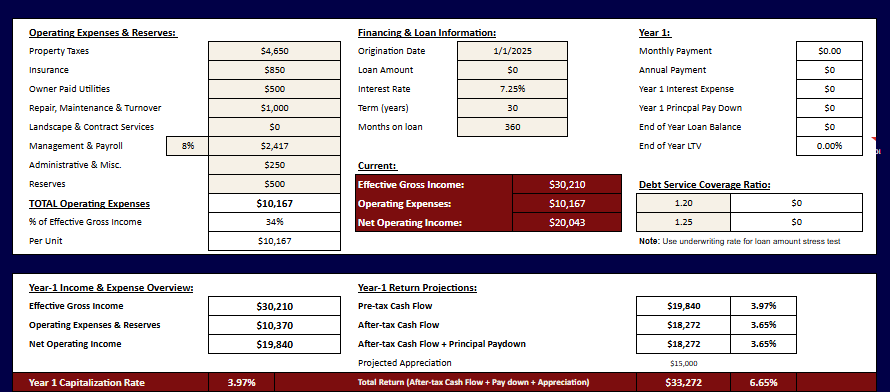

The photo is outlining the expenses and year-1 projections from CCRE's Property Analysis and Return Projections tool. The property would cash flow about $19,840/year (3.97% cash-on-cash) after factoring tax considerations would be $18,272 (3.62%). With no debt in place, there is no principal reduction or interst expense deductions (after-tax benefit).

To keep the illustration simple, lets assume all three properties perform the same and the combined market value of these three Oregon properties is $1,500,000, resulting in a capitalization rate (cap rate) of ~4%. ($60,000/$1,350,000} = 0.04).

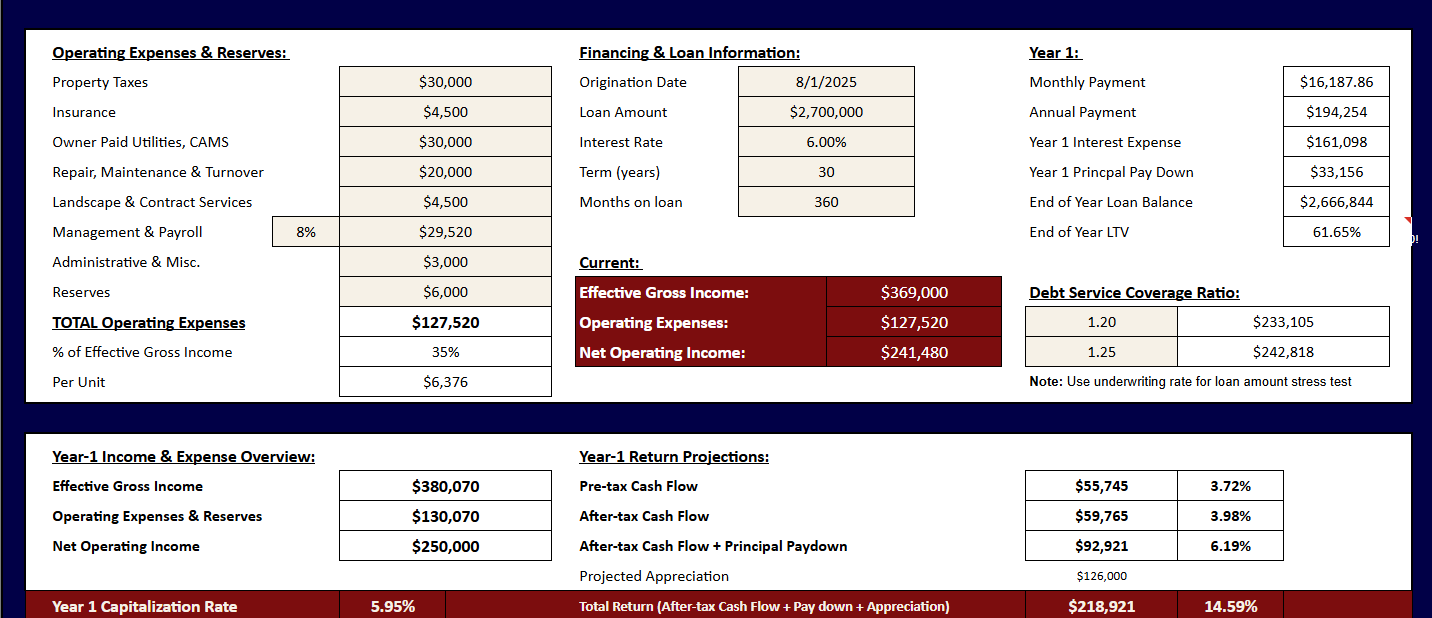

We can multiple the above factors to see how the CURRENT three properties would perform:

(1) Pre-tax Cash flow: ~$59,520

(3)After-tax Cash Flow + Principal Reduction: ~$54,816