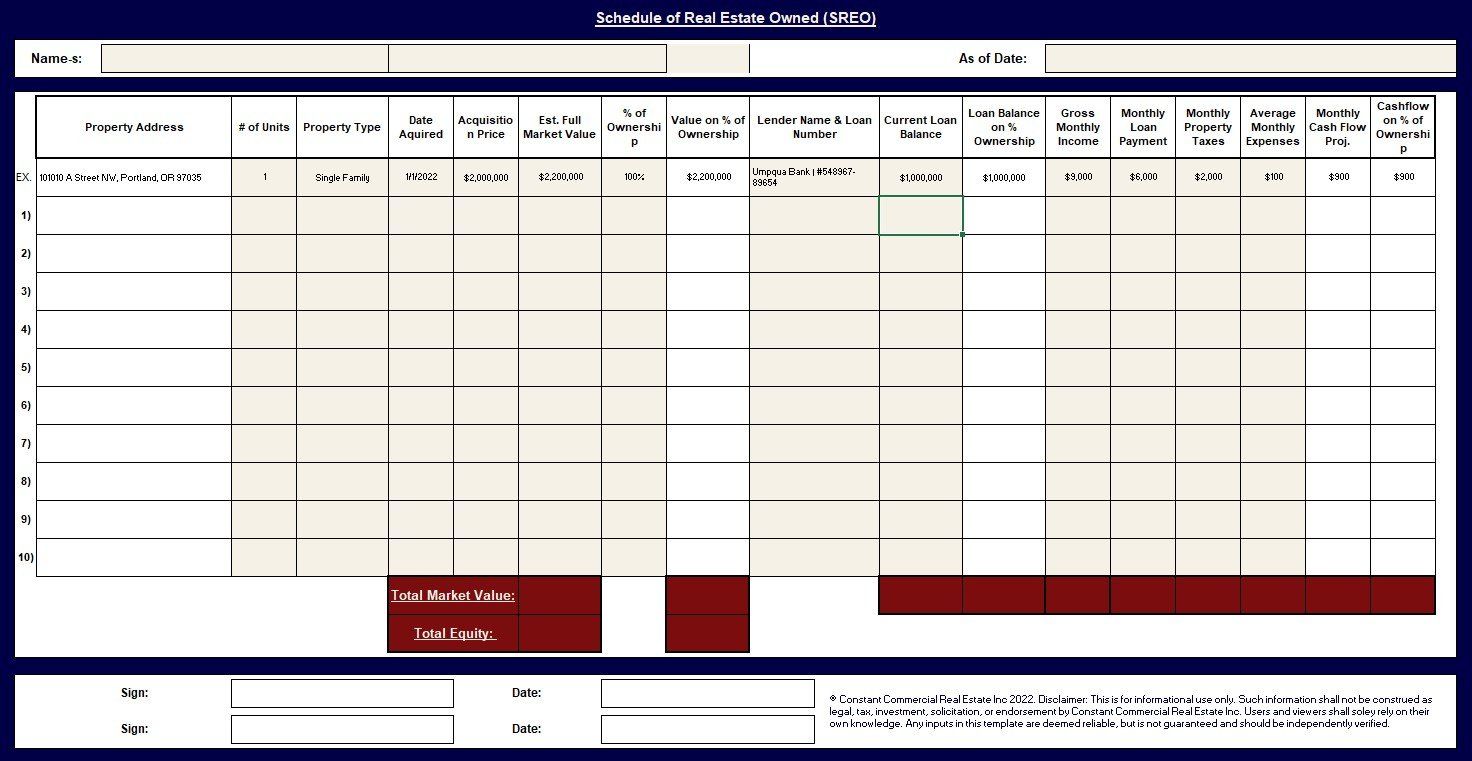

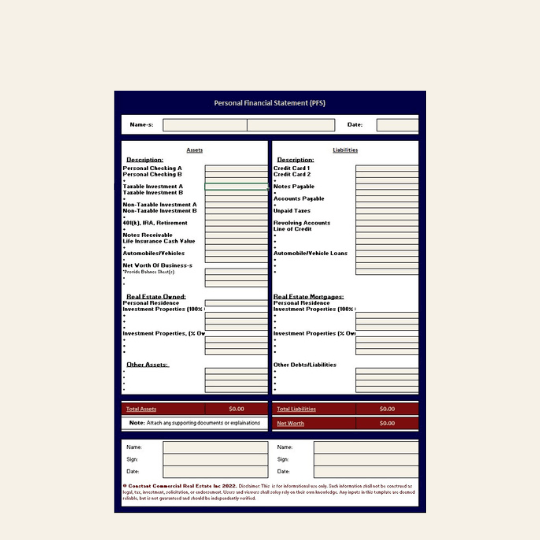

Resources, Insights & Case Studies

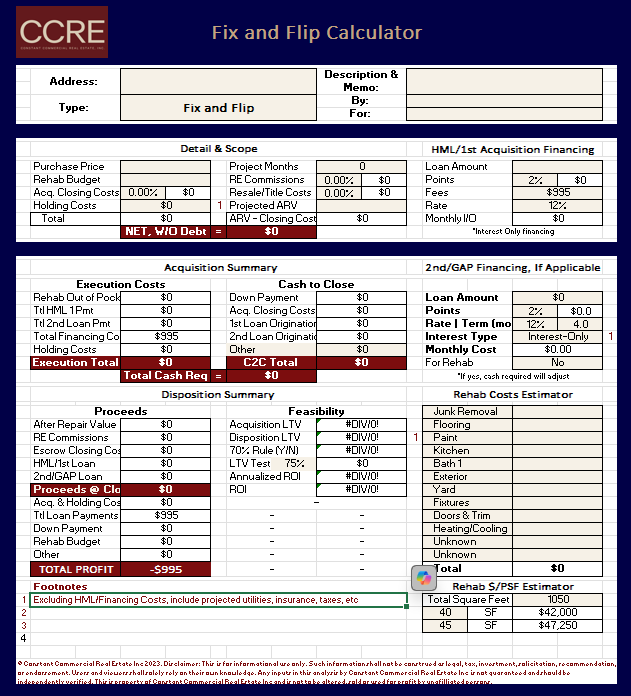

Useful proprietary analysis, templates and tools provided by CCRE. Insights and Case studies are frequently posted in blog form.

Join our email newsletter for prompt updates of new useful tools and content.

Articles & Insights

Resources & Links For Real Estate Investors

Commercial and Residential Listing Sites

-

RMLS or WVMLS

Portland and Mid-Willamette Valley Multiple Listing Service. Our brokers can create custom searches and a client portal to have listings with any criteria sent directly to you. Contact your CCRE advisor to refine your search criteria.

-

LoopnetList Item 2

Find commercial real estate for sale, lease & auction on the leading commercial real estate marketing and advertising marketplace.

-

Realtor.comList Item 3

Real Estate for sale near you. View photos, open house information, and property details for nearby real estate.

-

CrexiList Item 4

Buy, sell, or lease commercial real estate, including retail, office, industrial & multifamily properties all over the U.S.

Real Estate News & Resources

-

Multifamily NWList Item 3

Metro Multifamily Housing Association (MMHA) was created to represent residential property managers, owners, and vendors throughout Portland, Southern Washington, and down through the Willamette Valley to Medford. Our members manage over 200,000 units in these areas and represent every service related to the industry. In 2013, Metro Multifamily Housing Association became Multifamily NW to better reflect our diverse membership and affiliations.

-

BiggerPockets

BiggerPockets brings together education, tools, and a community of more than 2+ million members. Learn about investment strategies, collectively discuss investment real estate and make connections locally & nationally.

-

National Association of Realtors (NAR)List Item 4

The National Association of REALTORS® is America's largest trade association, representing 1.5 million members. Their site can provide quality national real estate and housing data.

-

CNBCList Item 2

Find the latest news, headlines, blogs and watch video about real estate, housing, mortgages, refinancing, apr and real estate markets from CNBC.com